Case Study: Honda Motor Co., Ltd. (7267)

Case Study: Honda Motor Co., Ltd. (7267)

Investment Rationale

Meets IRR Threshold: EPS is projected to grow from ¥179 to ¥397, with consistent share buybacks. Assuming a stable PER, dividend-inclusive IRR exceeds 20%.

Low GP Multiple: Market cap/gross profit = 1.56× (or ~1× excluding net cash and lease assets). In FY2012, the same ratio was 2.73×.

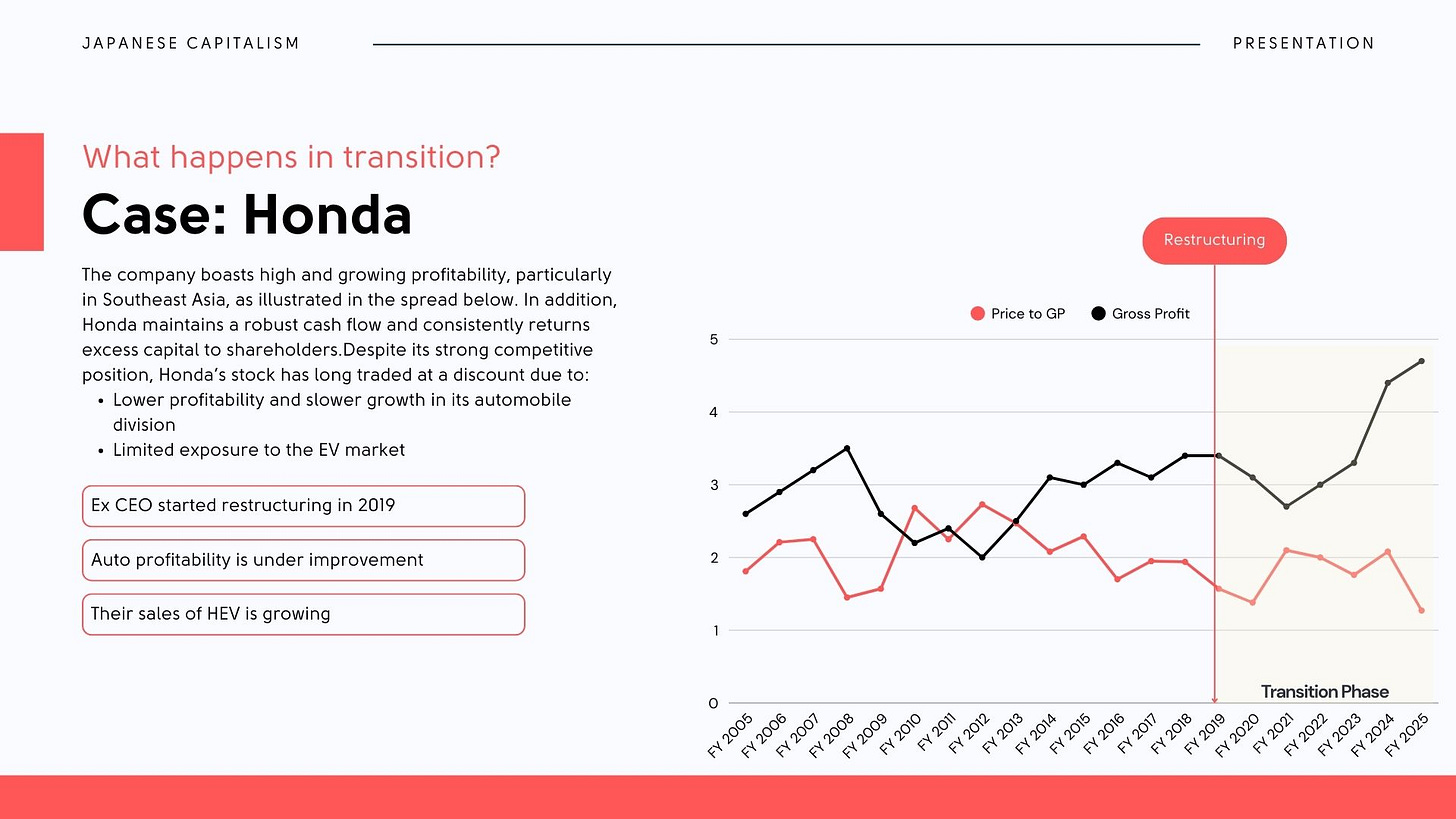

Stable Gross Profit Growth:

20-year CAGR: 3.96%

10-year CAGR: 5.17%

5-year CAGR: 9.55%

Motorcycle business volume and OPM improved from 15.13M units / 12.6% (2021) to 20.57M / 18.3% (2025).

Attractive EV/EBITDA: 5.24×

Balanced Shareholder Base:

Financial institutions: 27.9%

Foreign investors: 30.9%

Individuals: 13.3%

Only BlackRock disclosed >5% ownership during 2024–2025

Defined Financial Targets: ROIC 10%, OPM 10% by FY2031

Incentive Alignment: 50% of executive LTI is equity-based; 20% TSR-weighted

Why Invest?

Honda has a highly profitable and competitive motorcycle business in ASEAN, and its four-wheel (non-BEV) business is recovering. Despite generating ~¥3T in gross profit and pre-R&D OCF, its market cap (net of cash) is ~¥3T. The company remains undervalued due to delays in HEV modularization and low OPM relative to Toyota and others. However, ongoing restructuring and BEV margin improvements suggest limited downside, especially if Honda withdraws from China. Upside includes potential profitability in aerospace and aviation engine businesses.

Investment Timing

Investment will commence promptly after capital call.

Investment Purpose

Primarily for pure investment and value enhancement. However, we may pursue constructive, friendly dialogue with management as part of engagement. Some activities may fall under “material proposals” under Japanese law.

Investment Policy

We aim to acquire shares through market purchases when prices are undervalued relative to net assets and projected cash flow. Through long-term investment, we seek to benefit from TSR improvement driven by business growth and capital efficiency initiatives. During the holding period, we may highlight strategic issues to management and markets to ensure fair valuation.

Exit Plan

Returns will be collected through dividends during the holding period and through market sales by ~2030. If the company remains undervalued, options include in-kind distribution to LPs or fund term extension.

Engagement Letter Outline: Honda

Governance Observations

Capital allocation toward four-wheel, BEV, and aviation businesses appears excessive relative to high-margin motorcycle operations. ROIC and capital efficiency targets are lacking (except in mid-term plan), making it difficult to assess capital discipline.

Recommendations

Executive Compensation

Increase LTI (long-term incentive) weight relative to short-term.

Raise TSR weighting in LTI KPIs.

Introduce ROIC/ROA as capital efficiency KPIs in LTI.

Link CEO and four-wheel exec compensation specifically to four-wheel OPM rather than companywide OPM.

Disclosure

Clearly disclose gross margin improvement targets for four-wheel business (including HEV) and BEV in-house production.

Disaggregate OPM and ROIC disclosures by segment (motorcycle by product/region; four-wheel by ICE/HEV/BEV; power products by line).